As part of a strategic merger, Metrostyle has been absorbed by Residential Attitudes, a proud member of the JWH Group. To ensure a seamless transition and provide you with an enhanced experience, we are redirecting you to the Residential Attitudes website.

Here you will find an array of inspiring designs, house and land packages and a team of professionals ready to guide you through the home-building process. Our goal remains unchanged: to create homes that inspire, reflect your individuality and bring your home vision to life.

BEAUTIFUL HOMES, AFFORDABLE PRICES

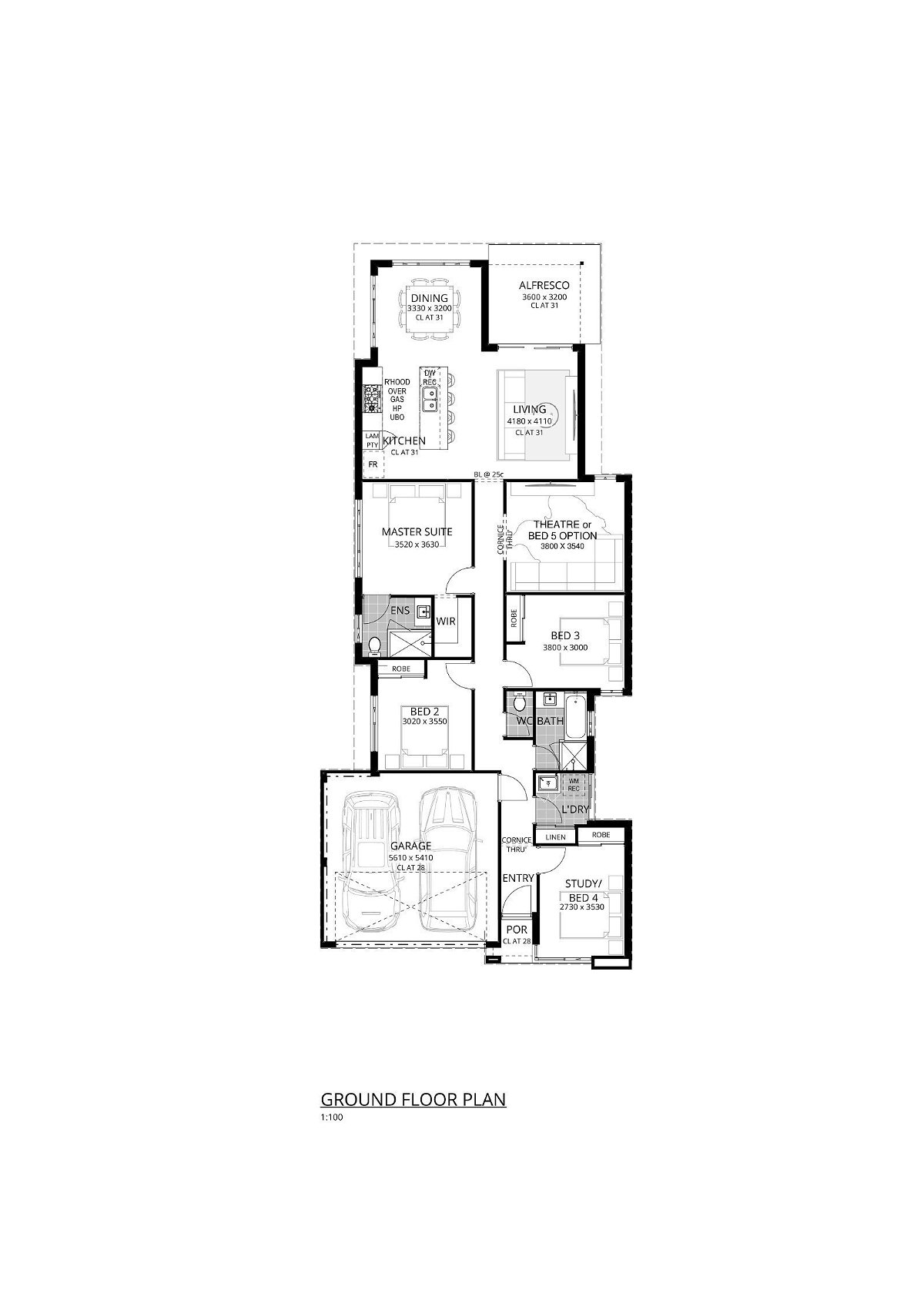

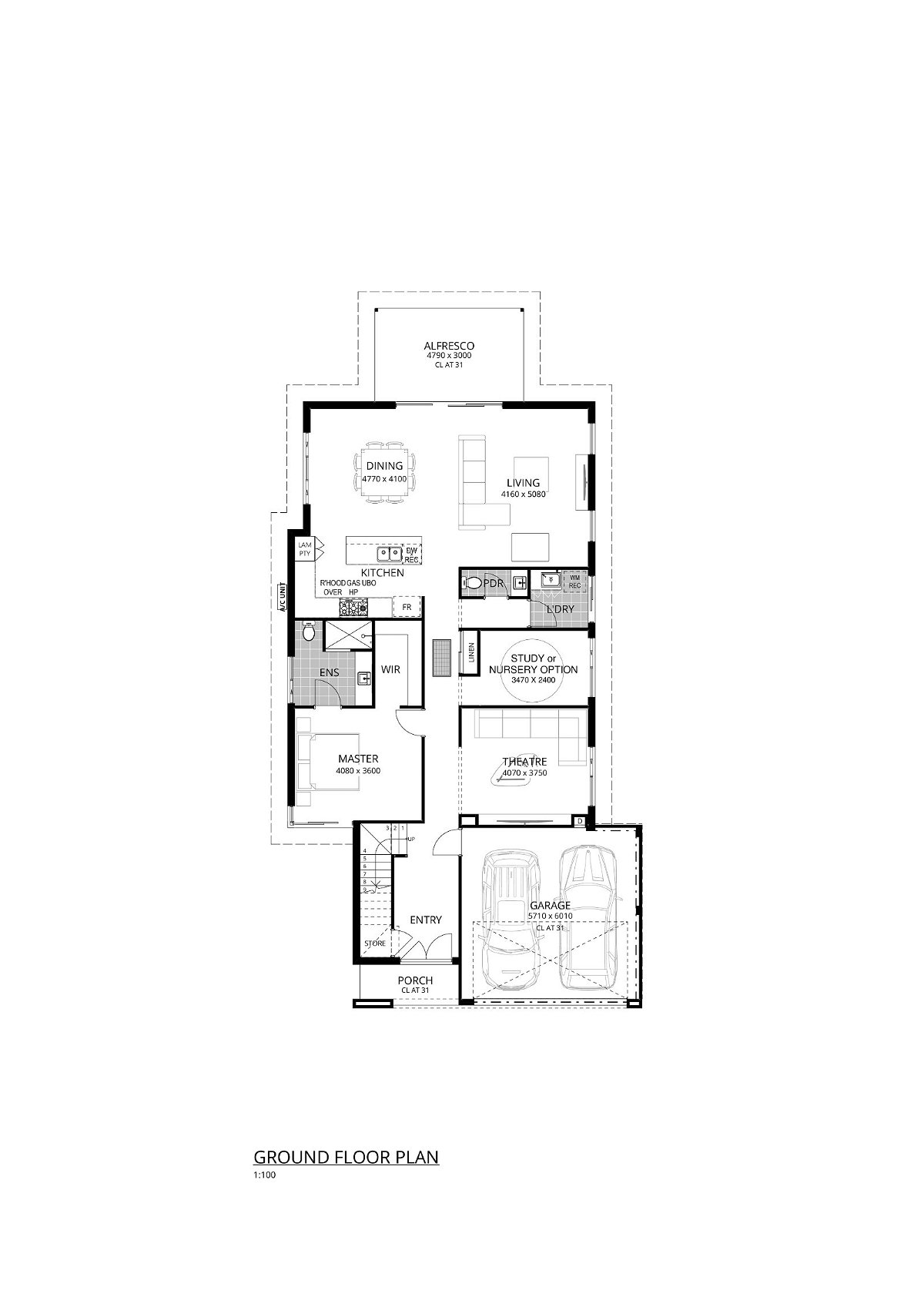

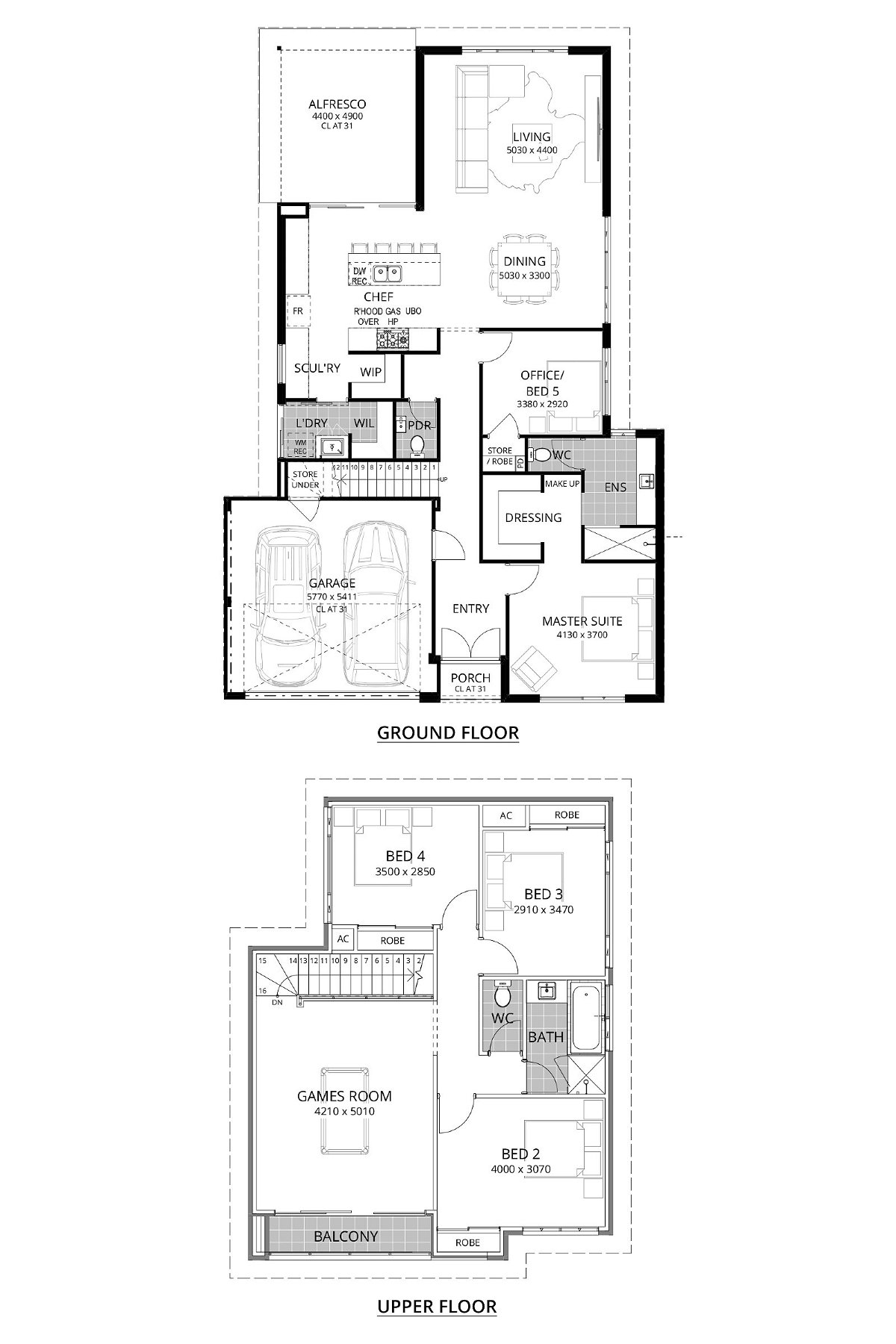

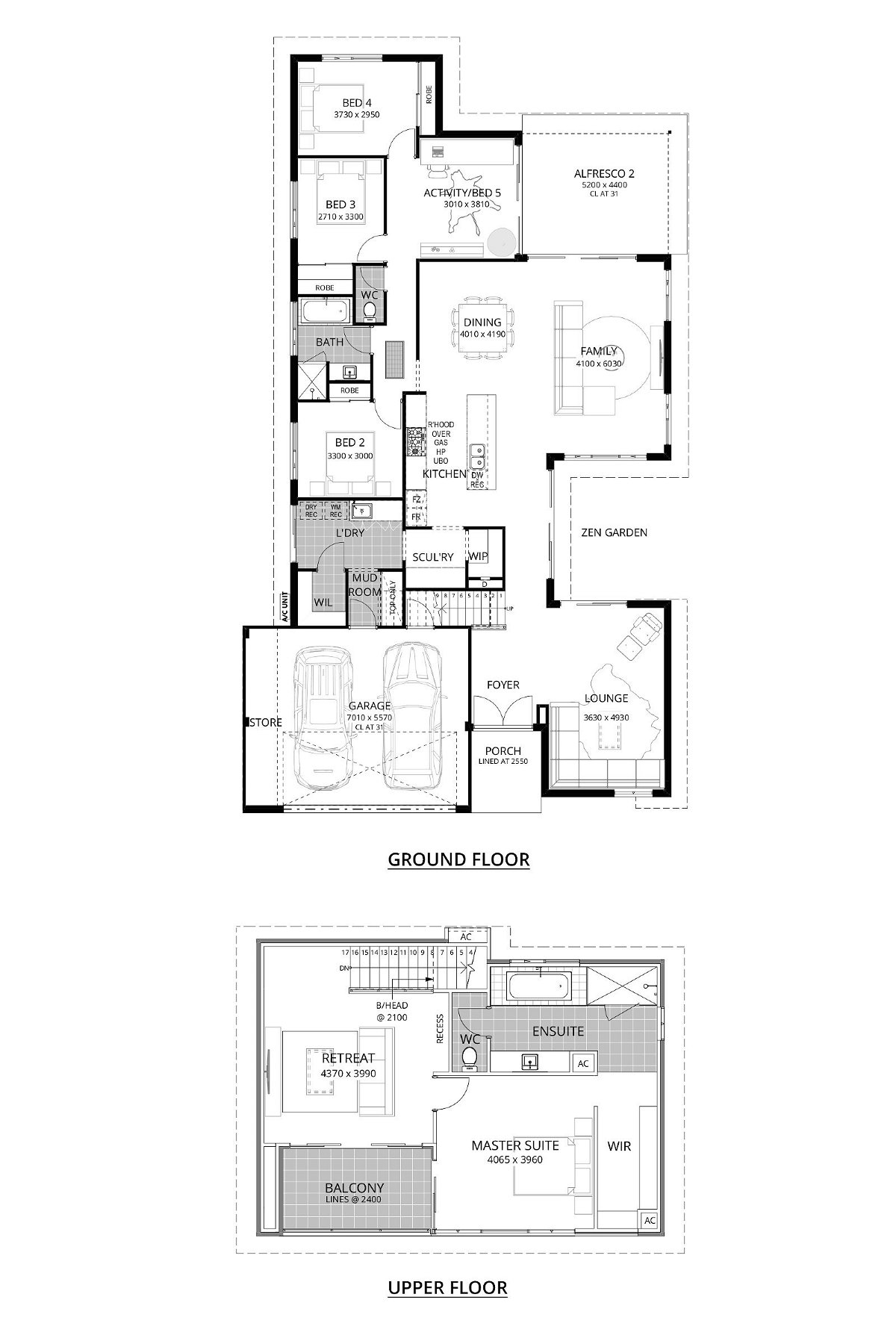

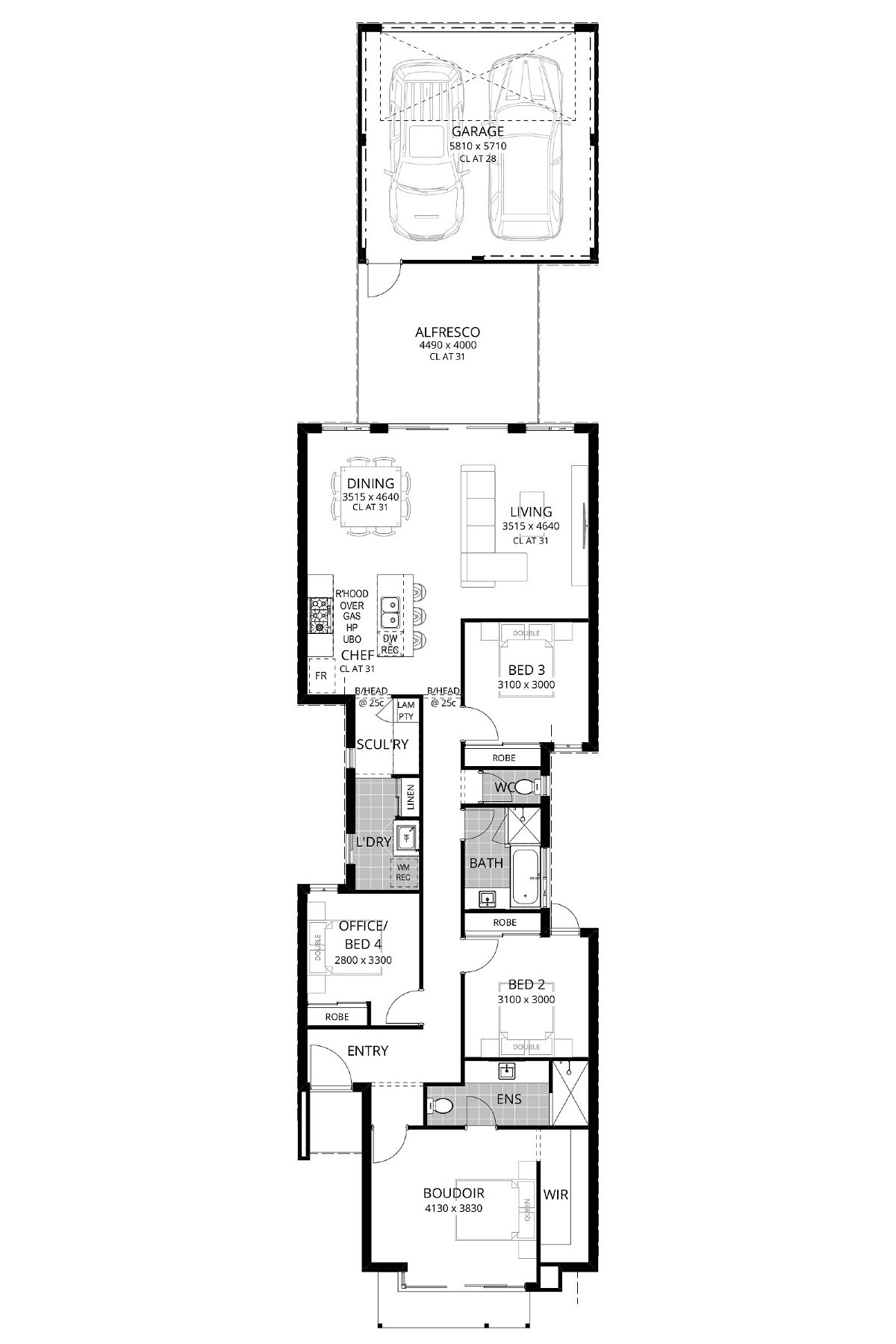

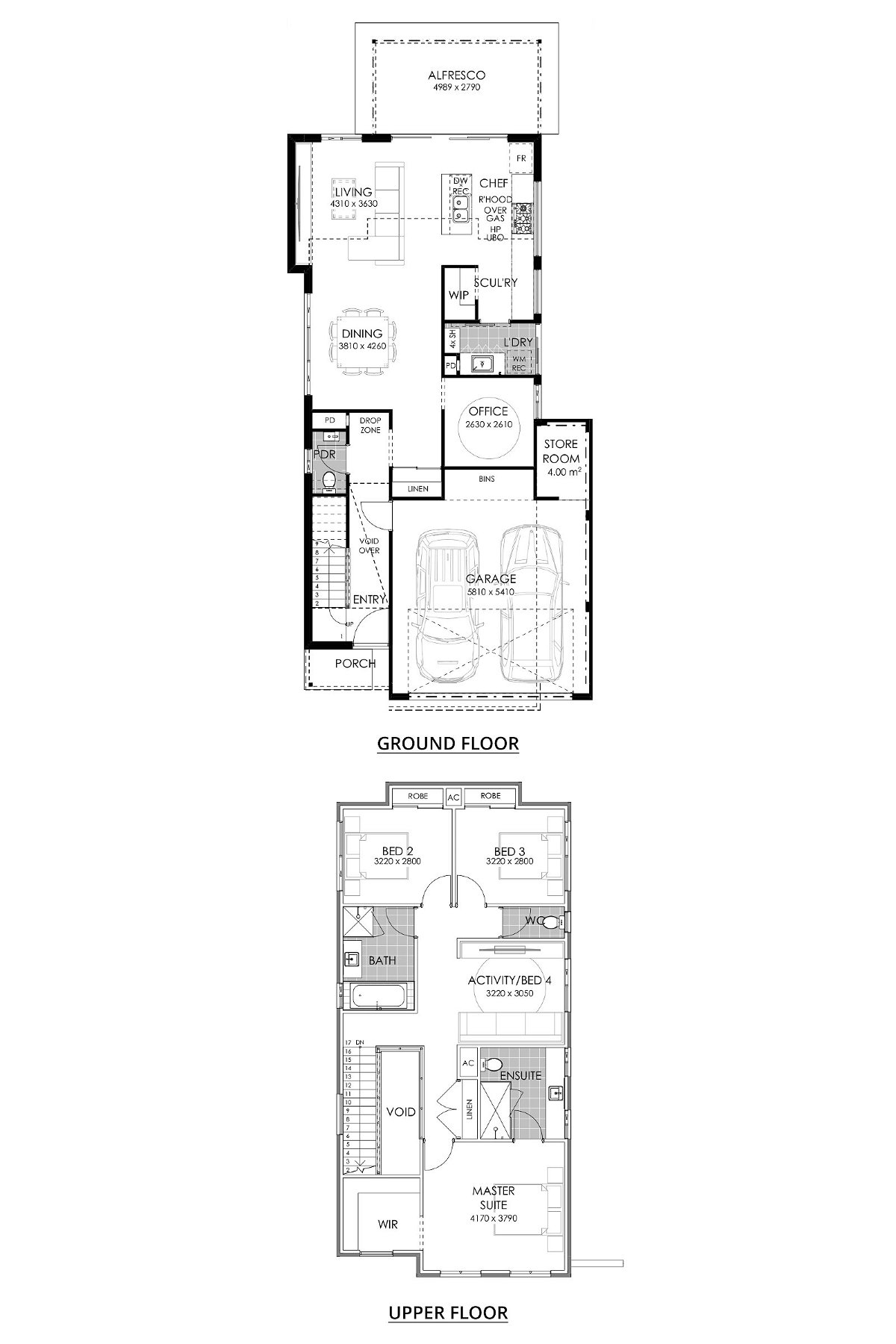

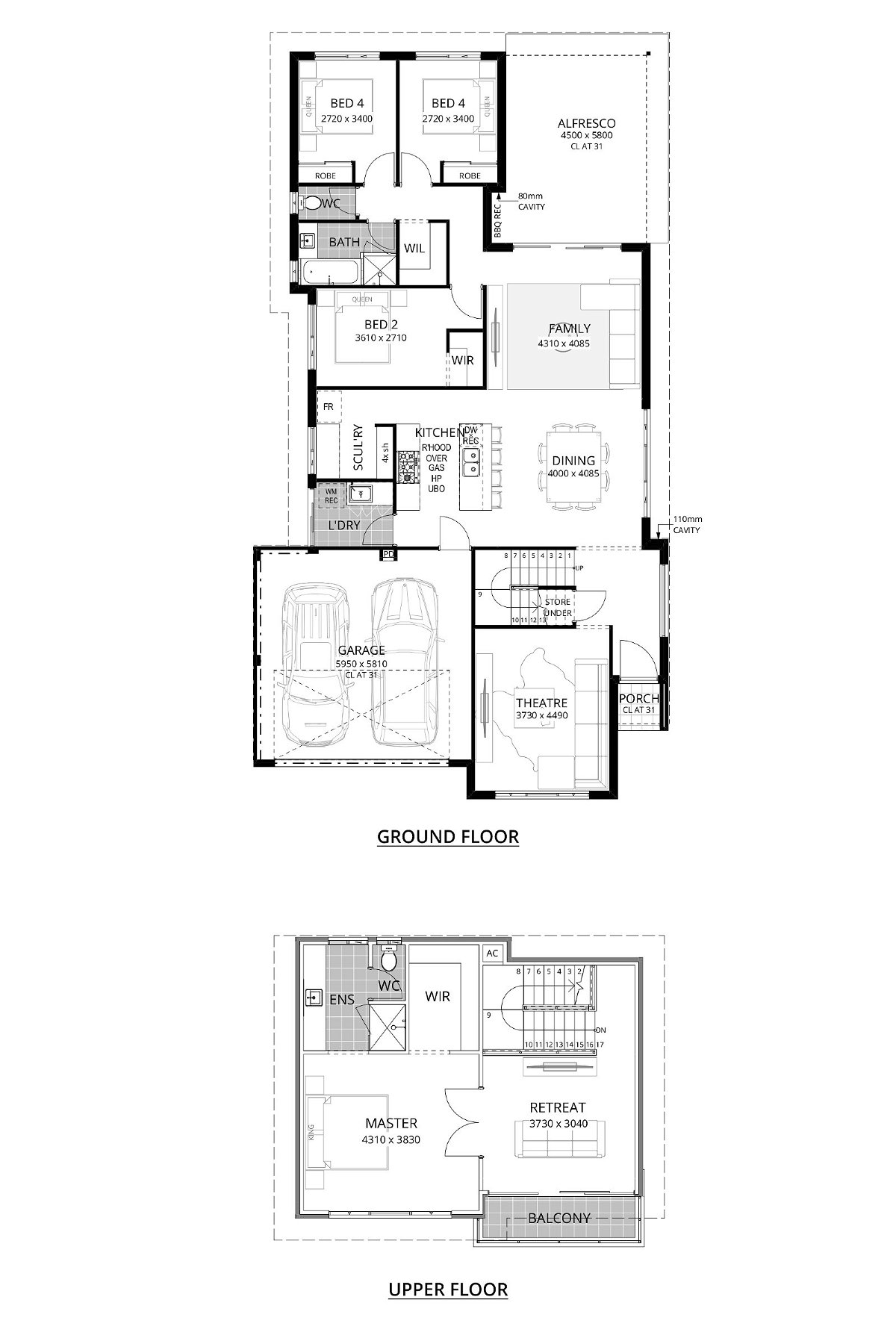

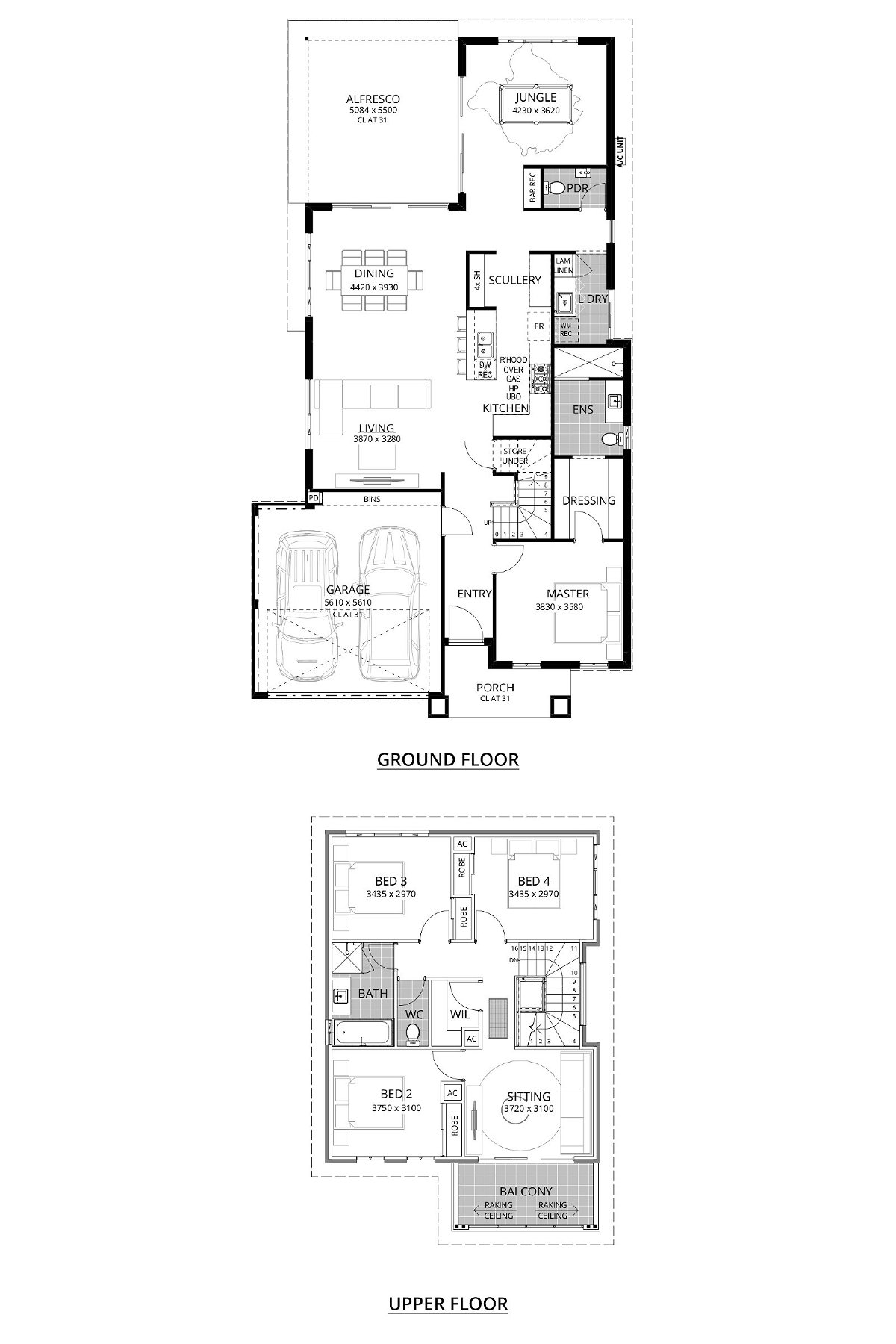

Residential Attitudes have a carefully curated range of designs specifically aimed for single-storey home buyers.

SELECT THE STYLE THAT’S RIGHT FOR YOU

When you’re looking for new single-storey homes in Perth, built with style, look no further than Residential Attitudes. Our ranges have been designed to suit a number of lifestyles and life stages.

And as part of one of Western Australia’s largest home builders, you can feel the confidence that comes from knowing your home is in experienced hands.

We have a wide range of stylish house designs and home and land packages in sought-after Perth suburbs. Start here to find a solution to suit your lifestyle and budget, whether you’re a first home buyer, already on the property ladder or an investor.

Take a look through our home designs to see which suits your lifestyle:

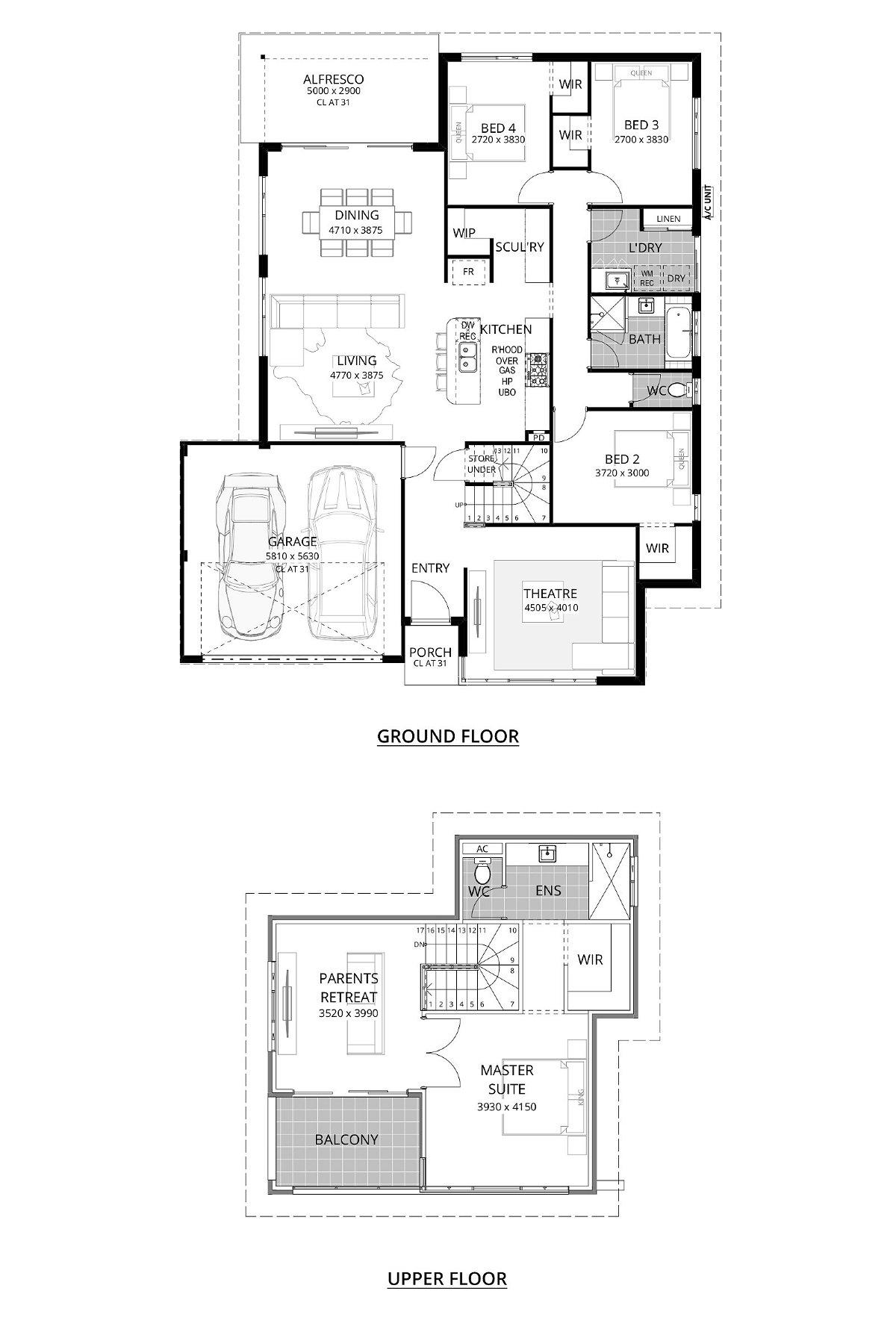

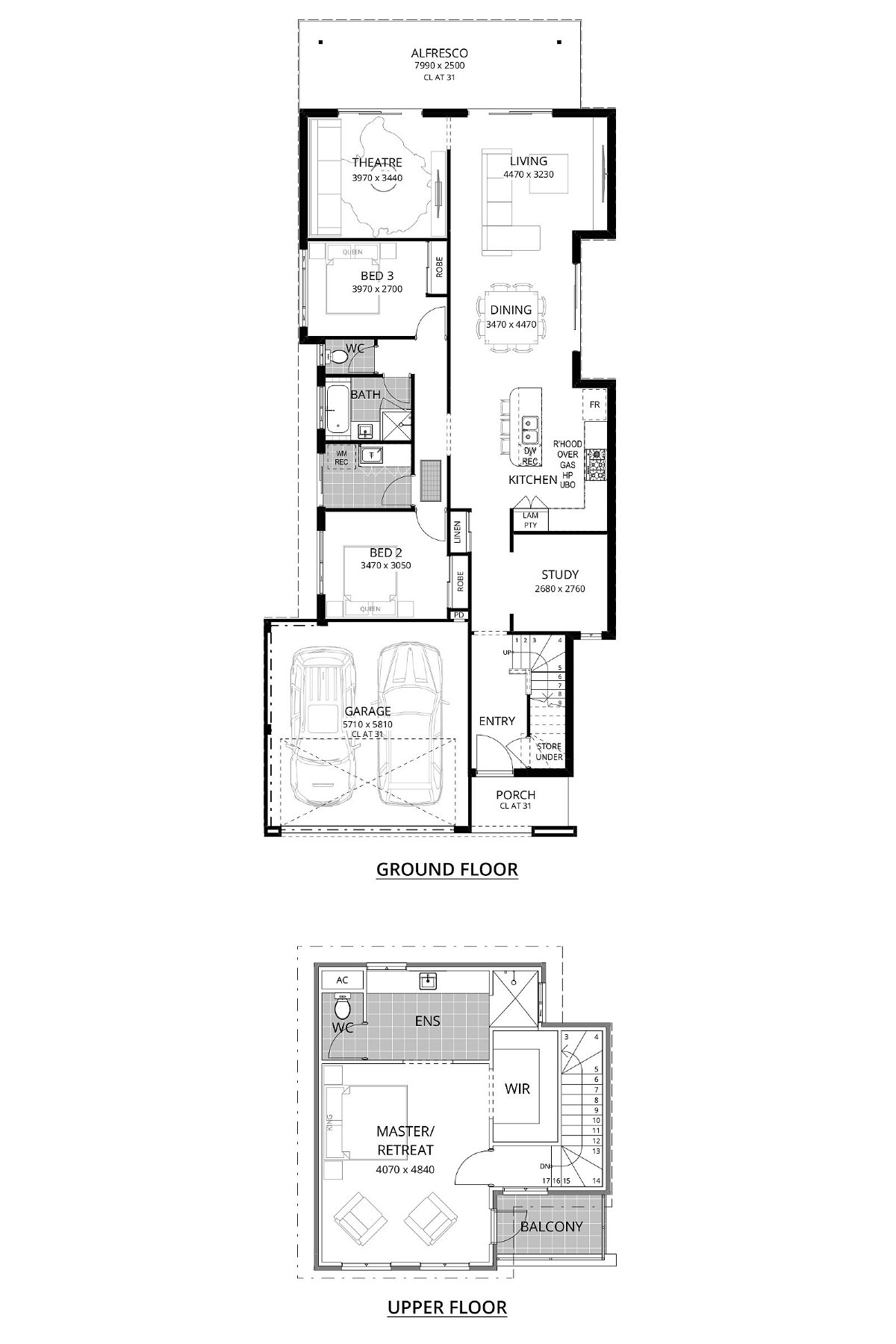

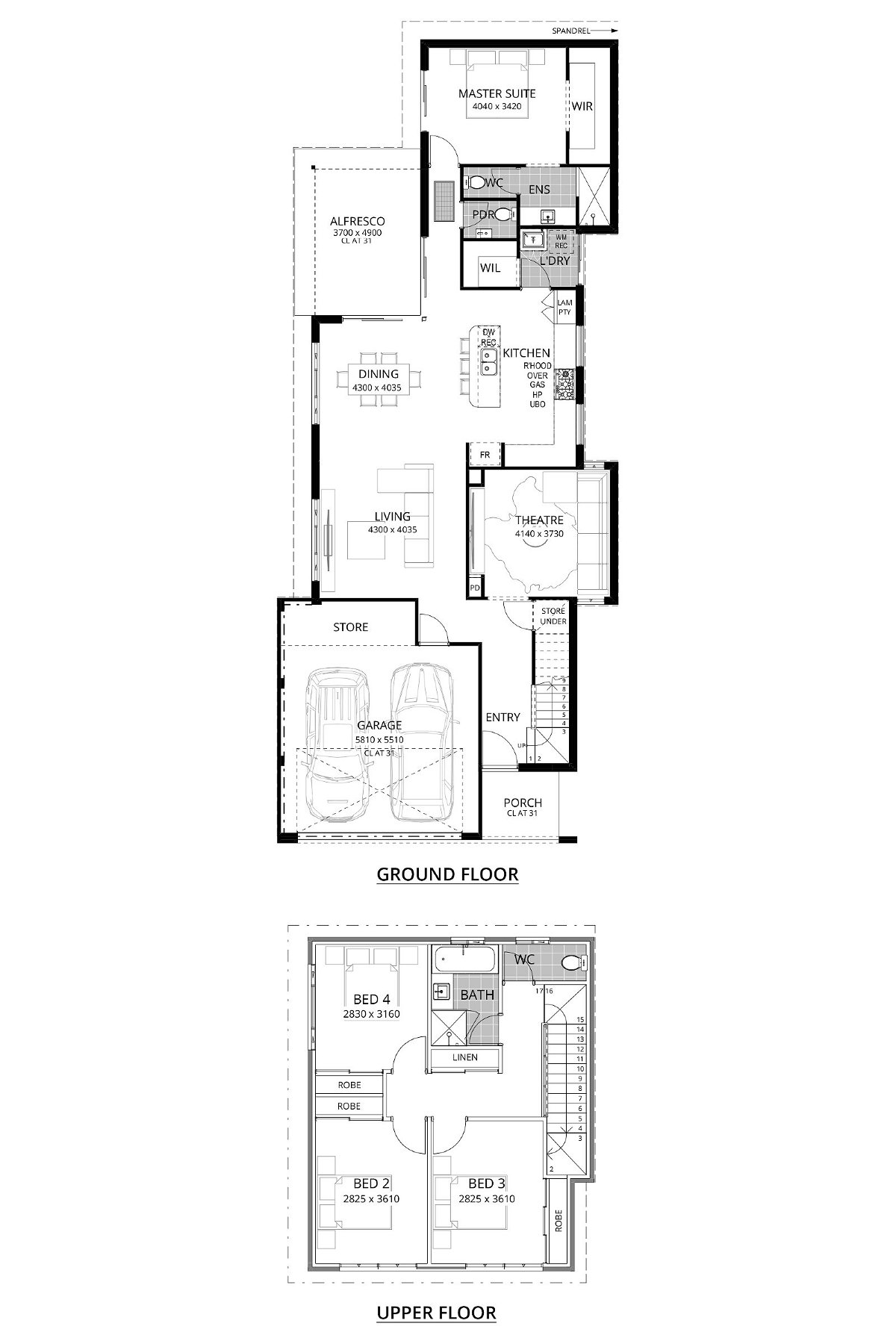

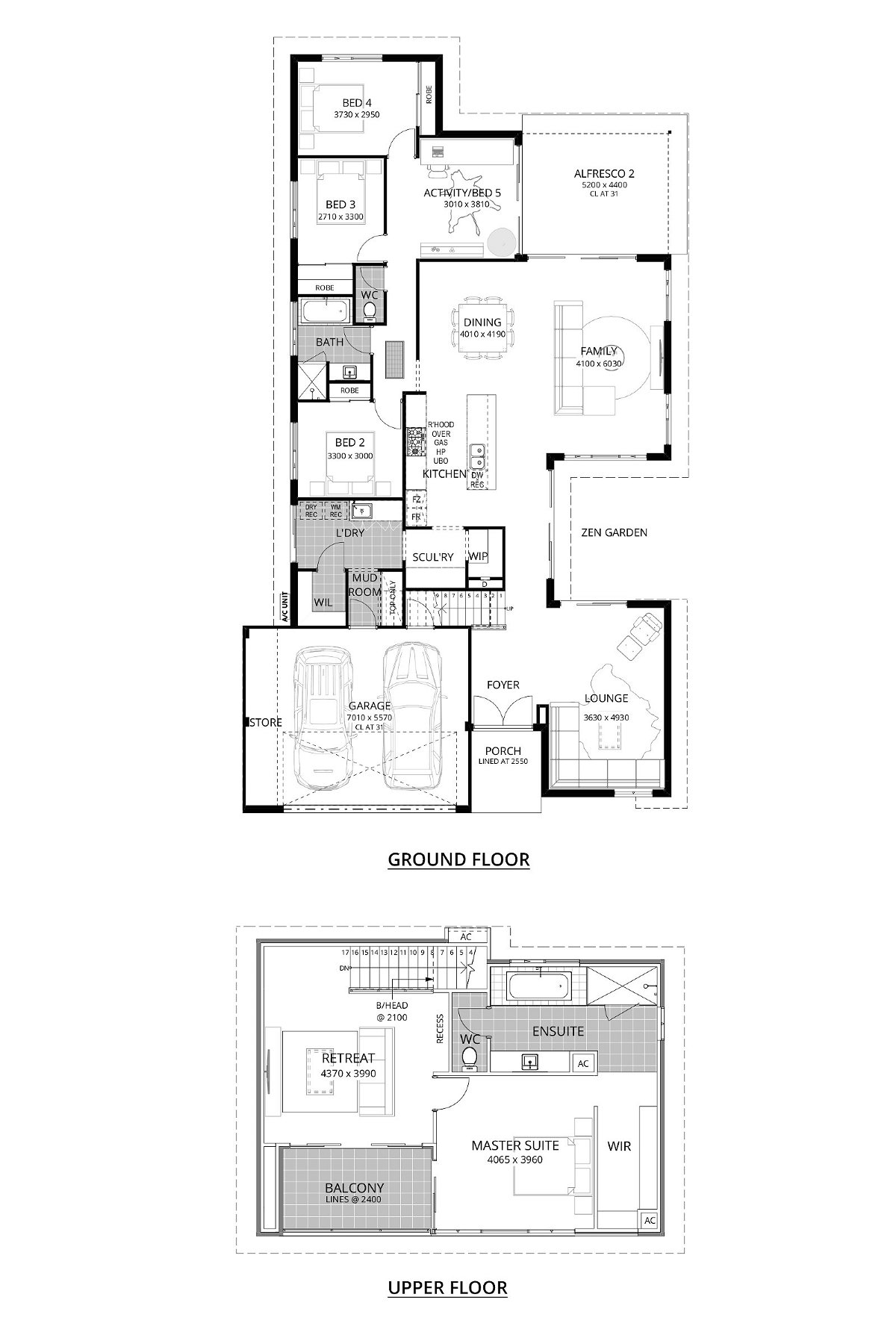

Our Designs

- Elevation

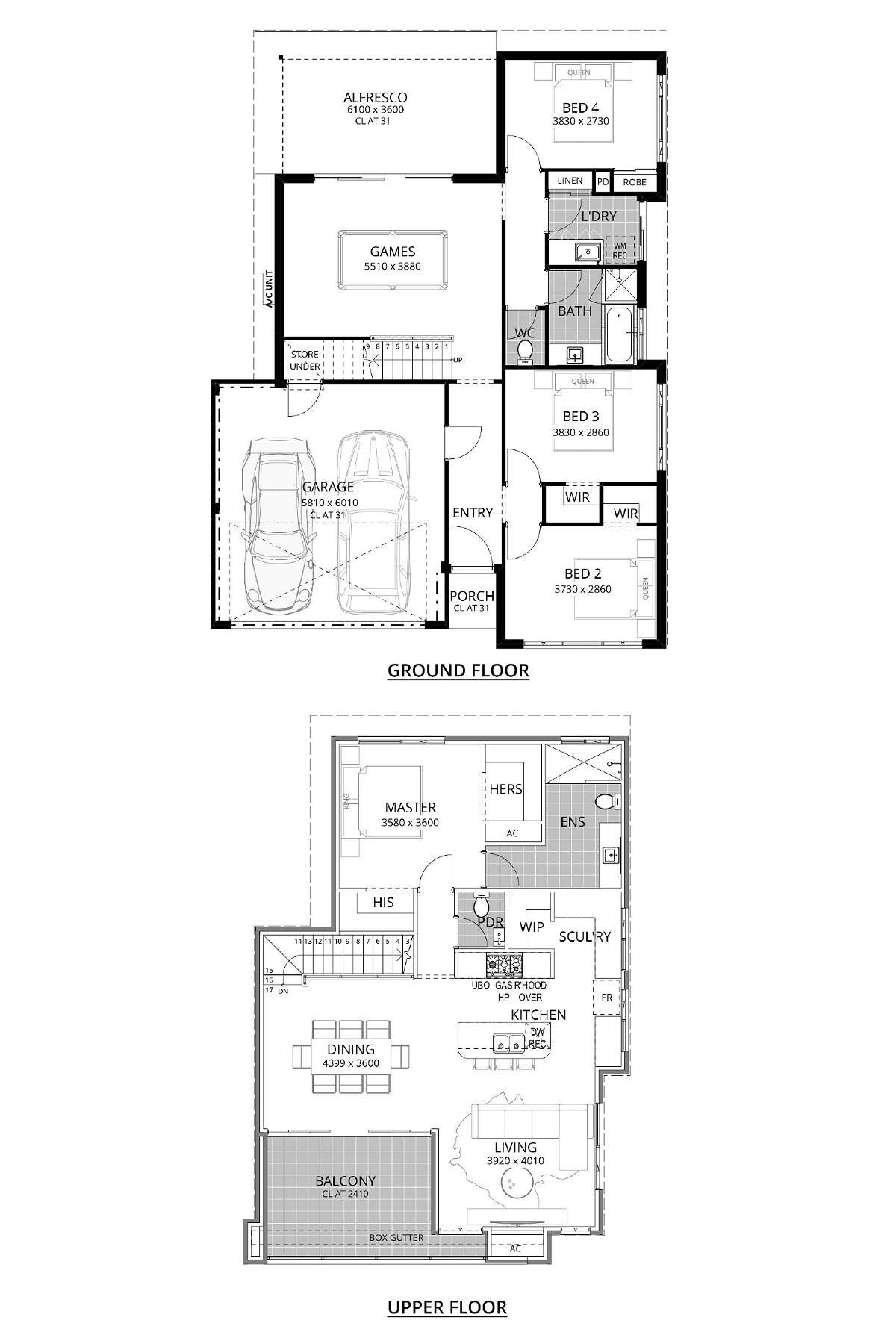

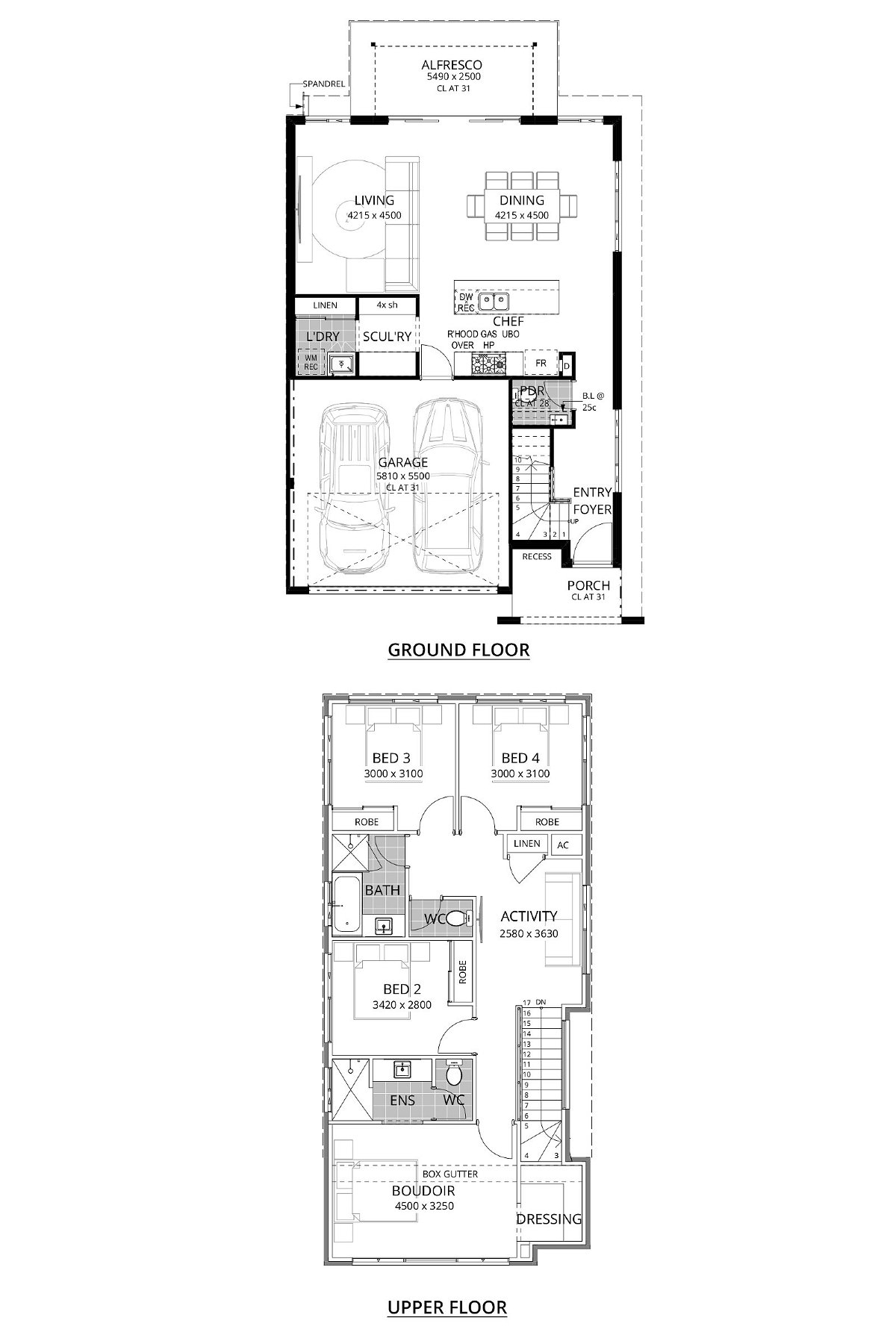

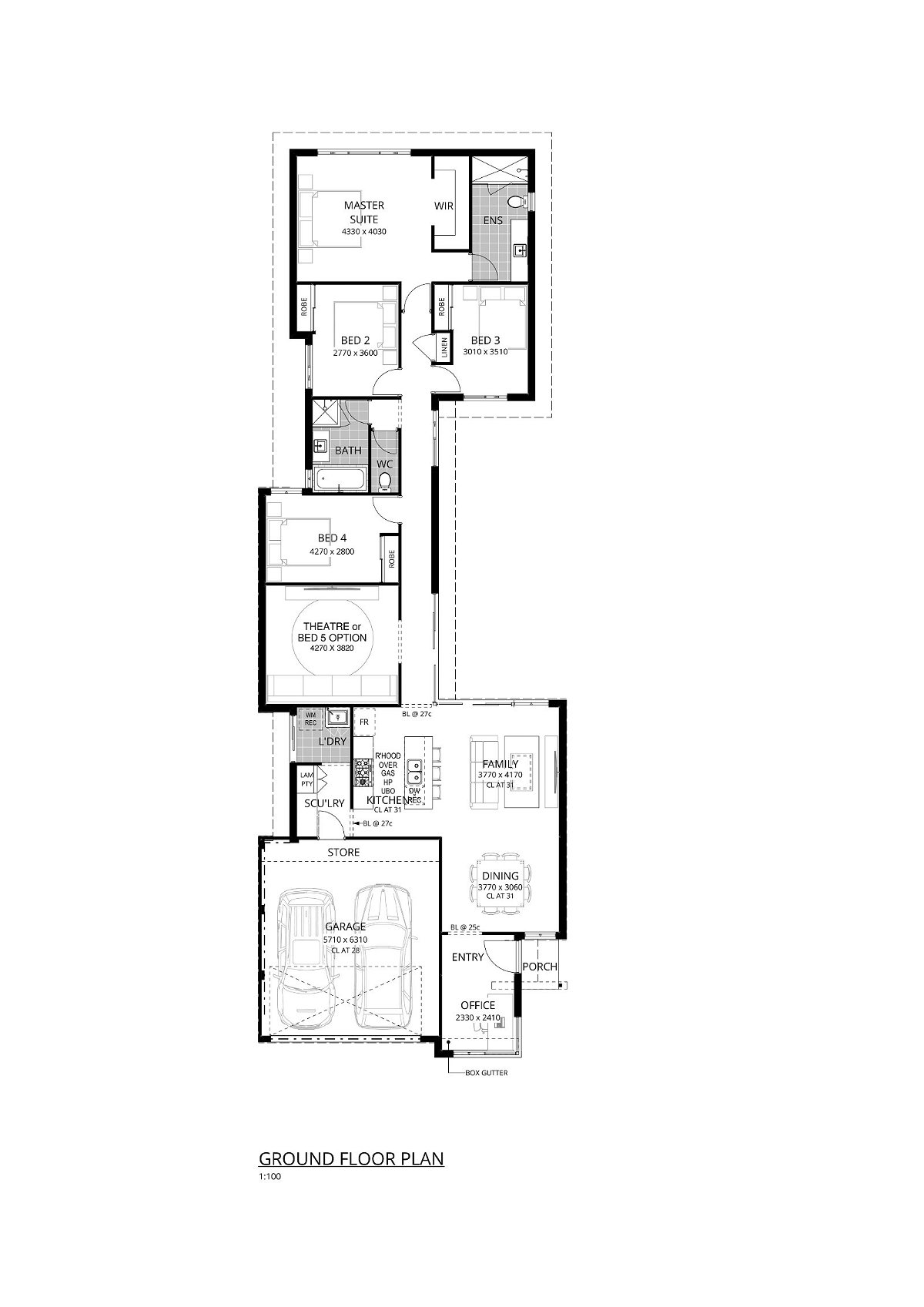

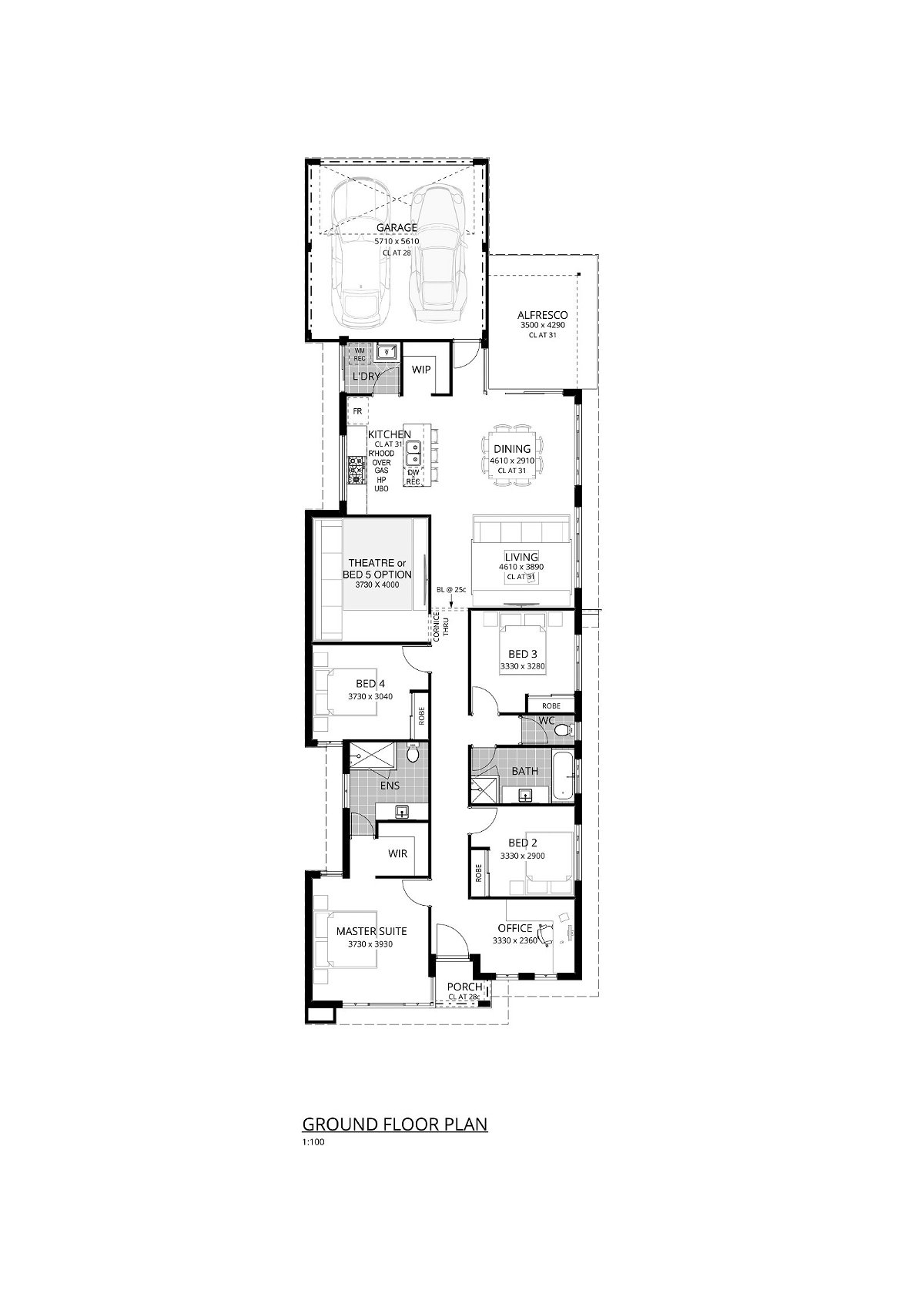

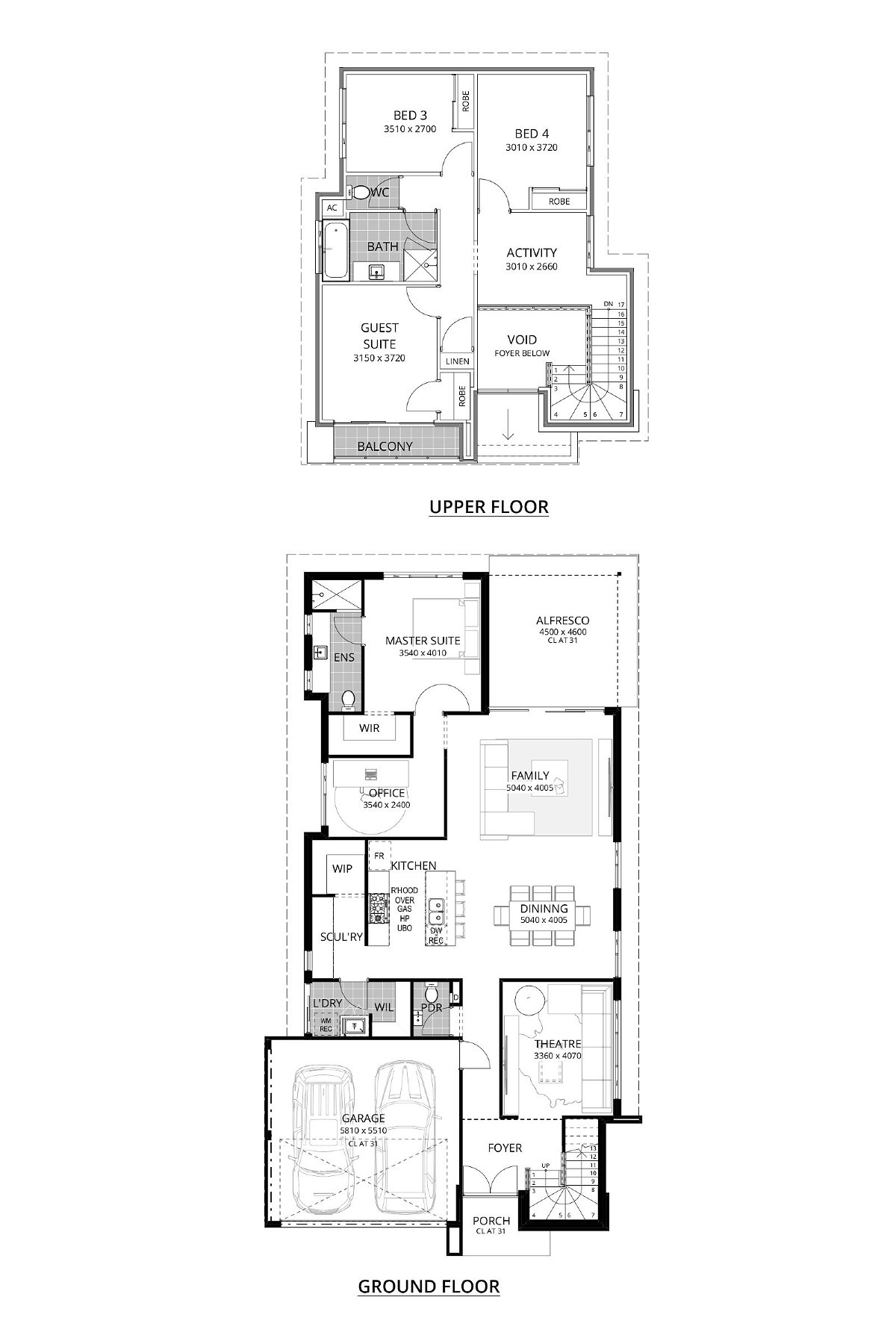

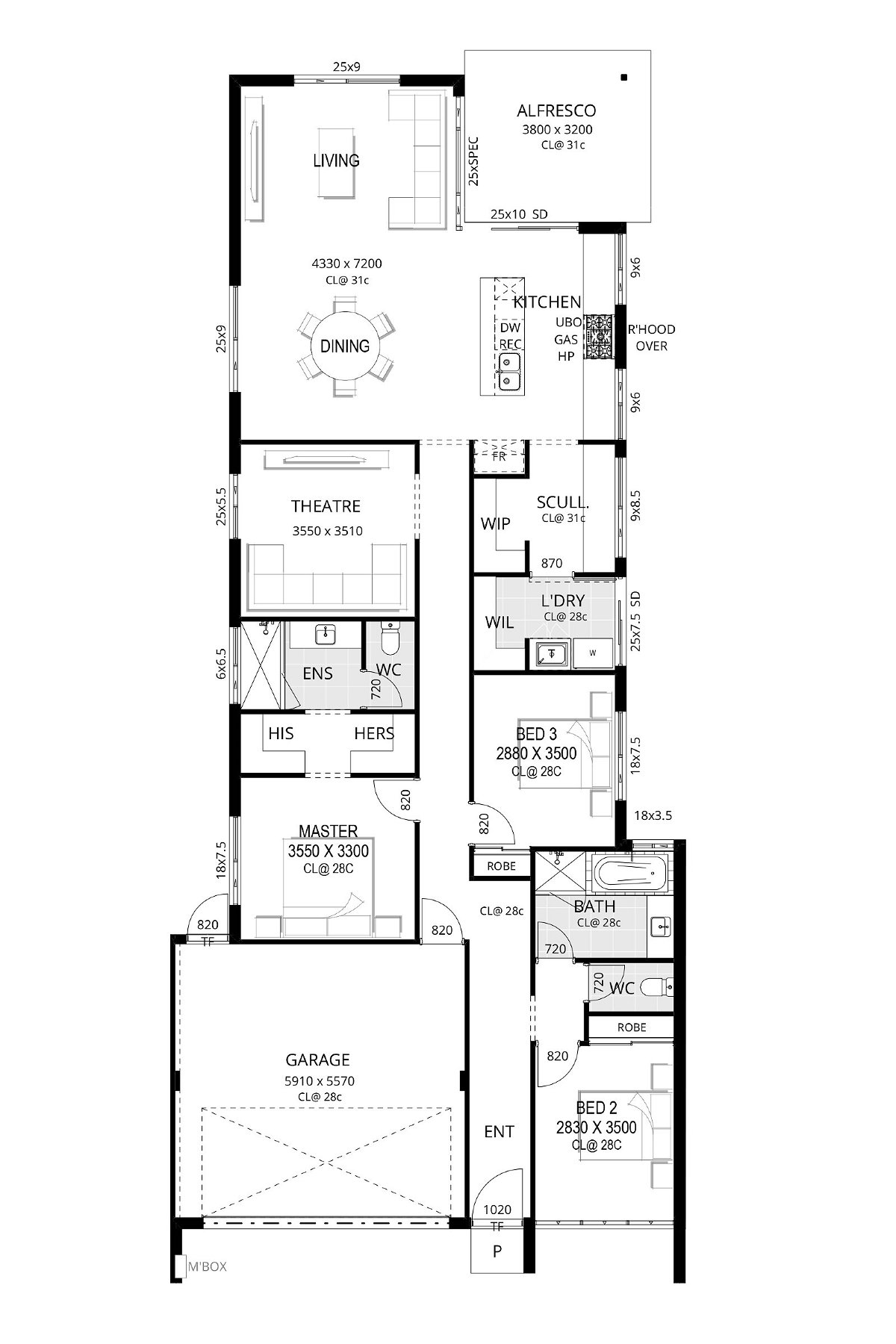

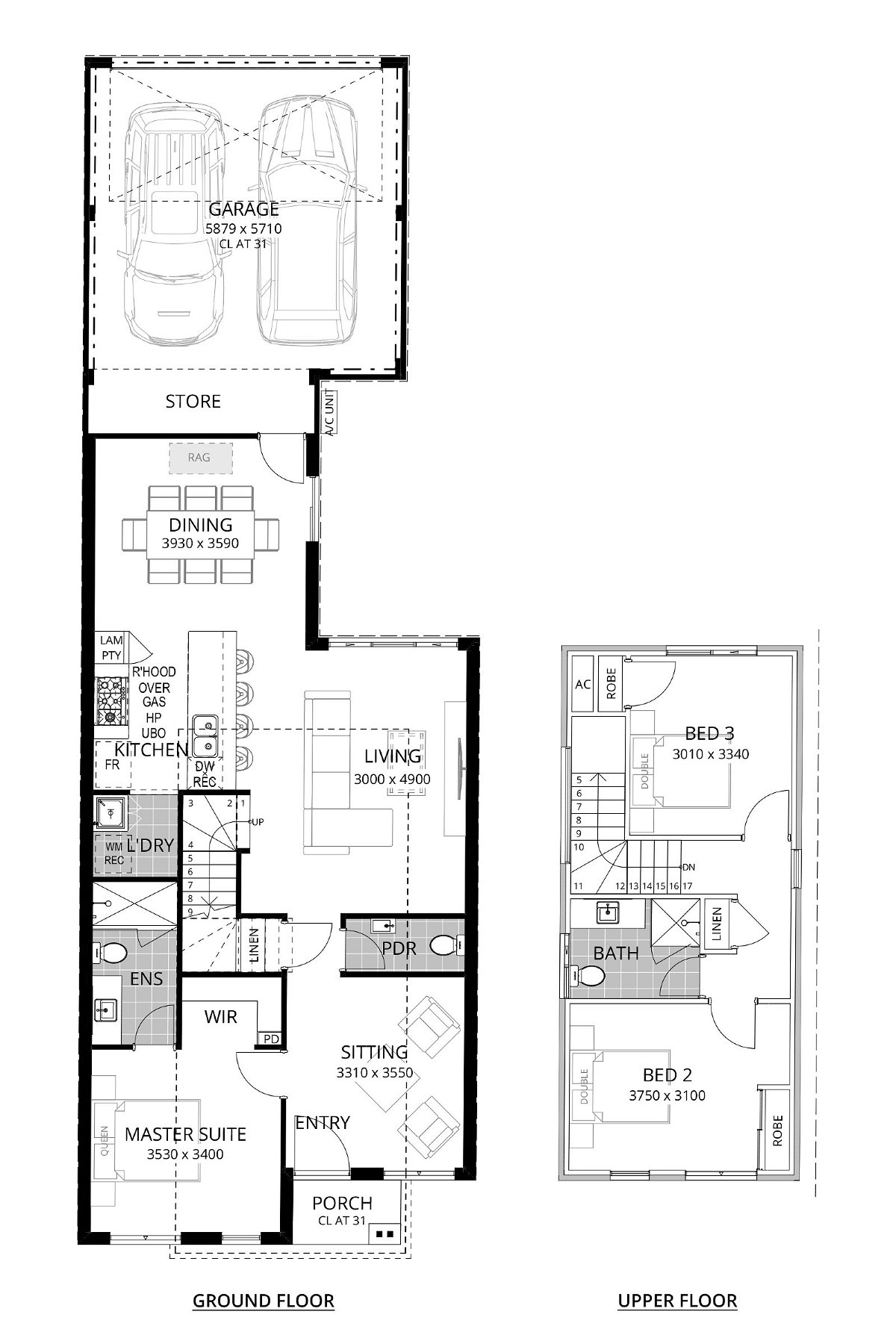

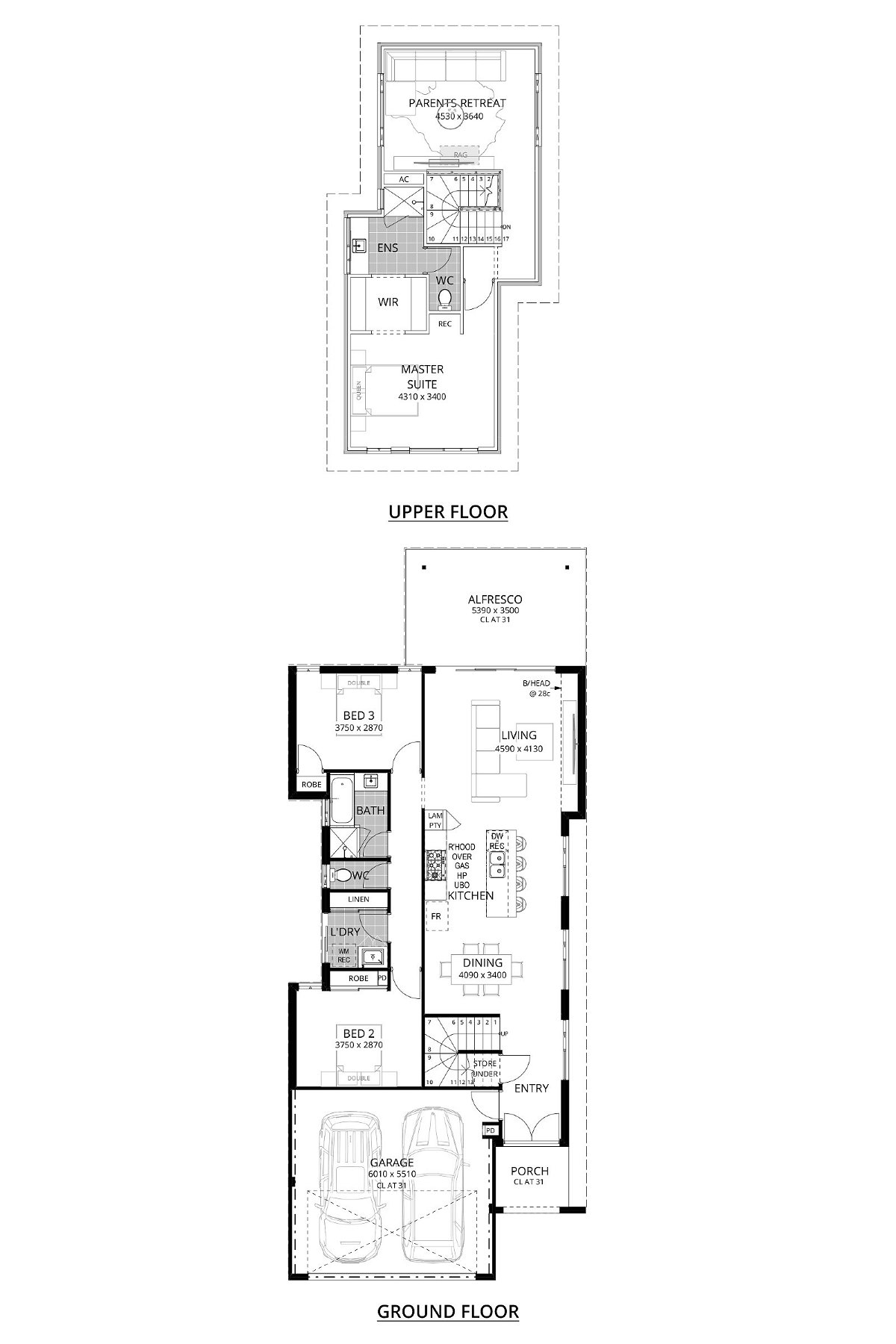

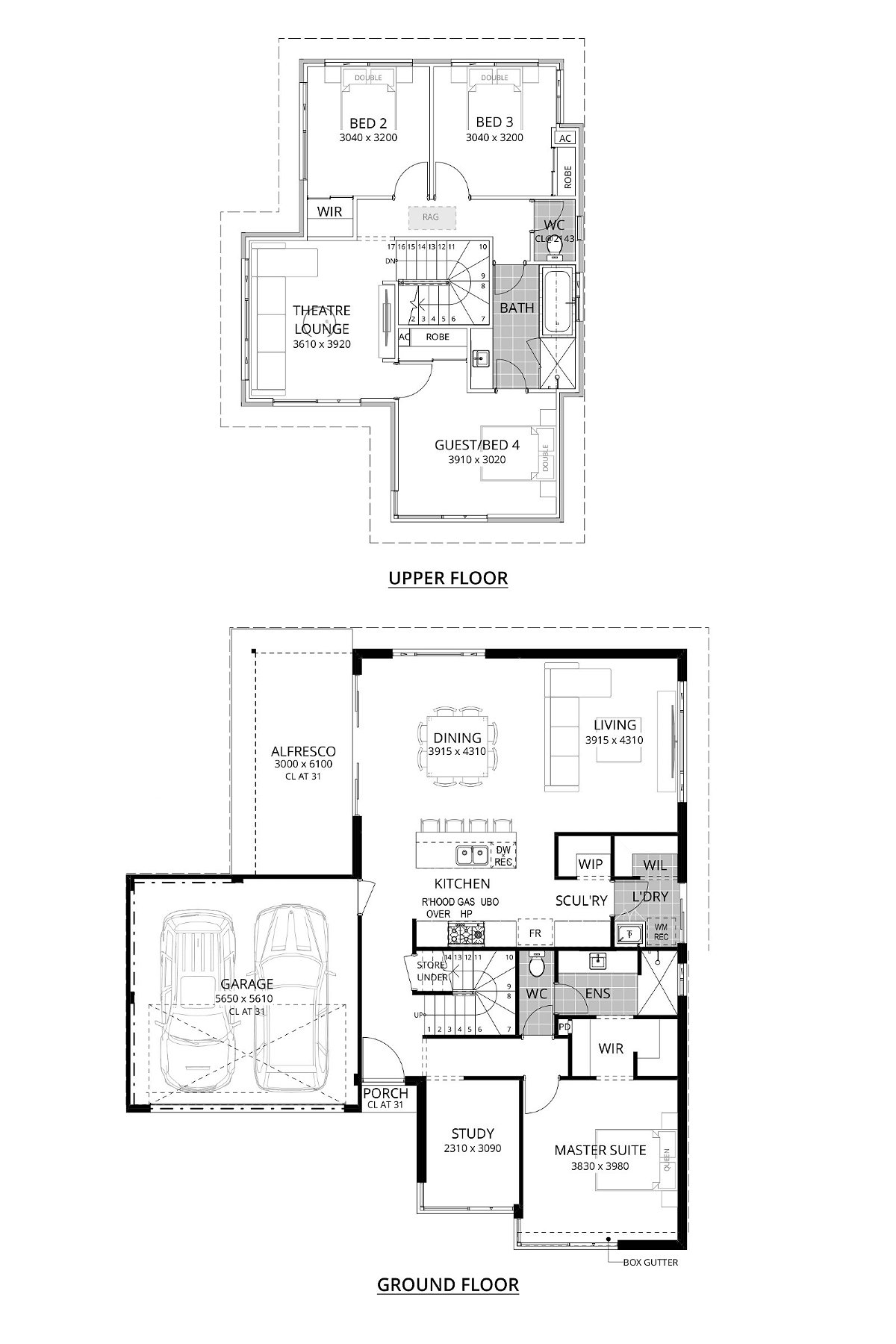

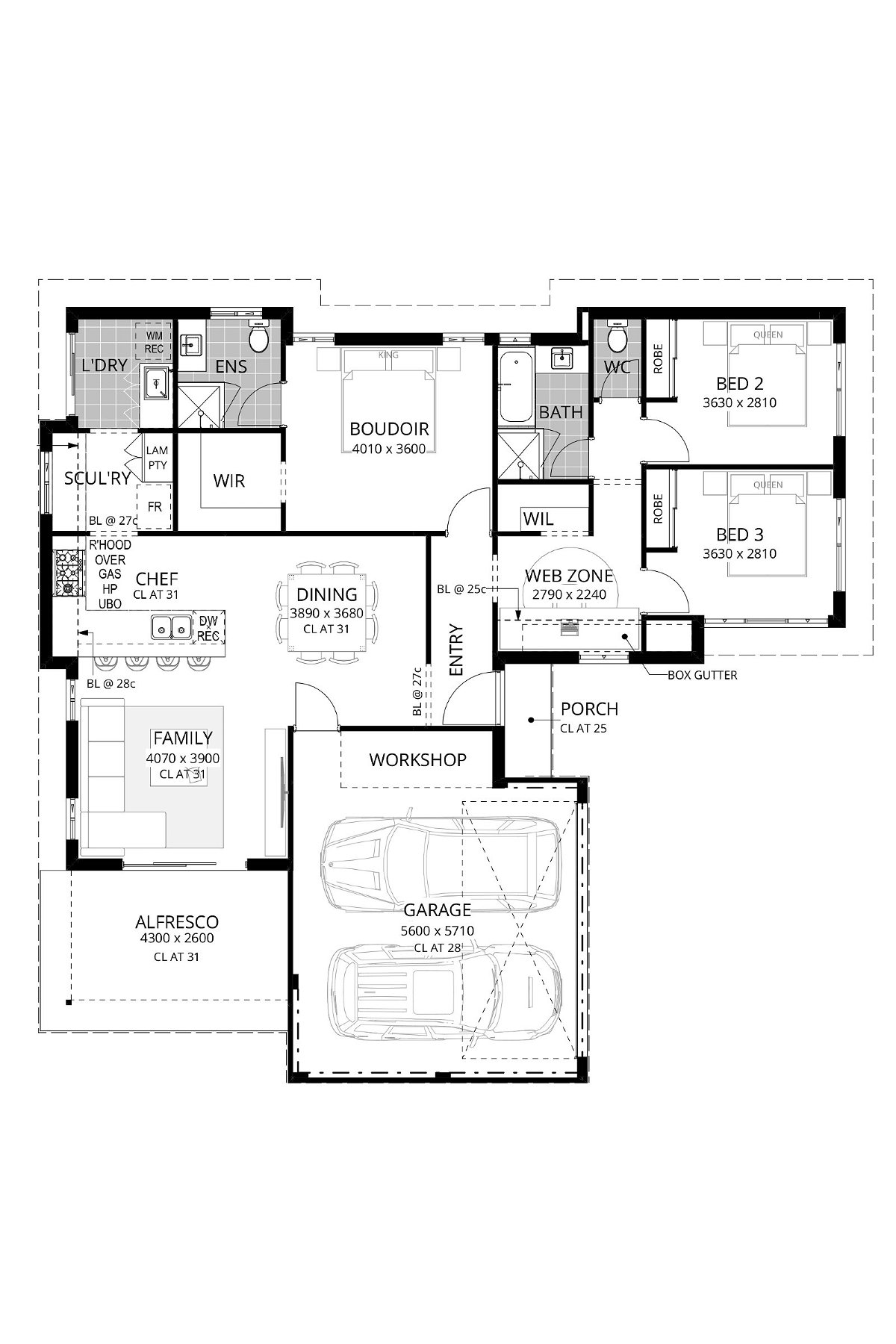

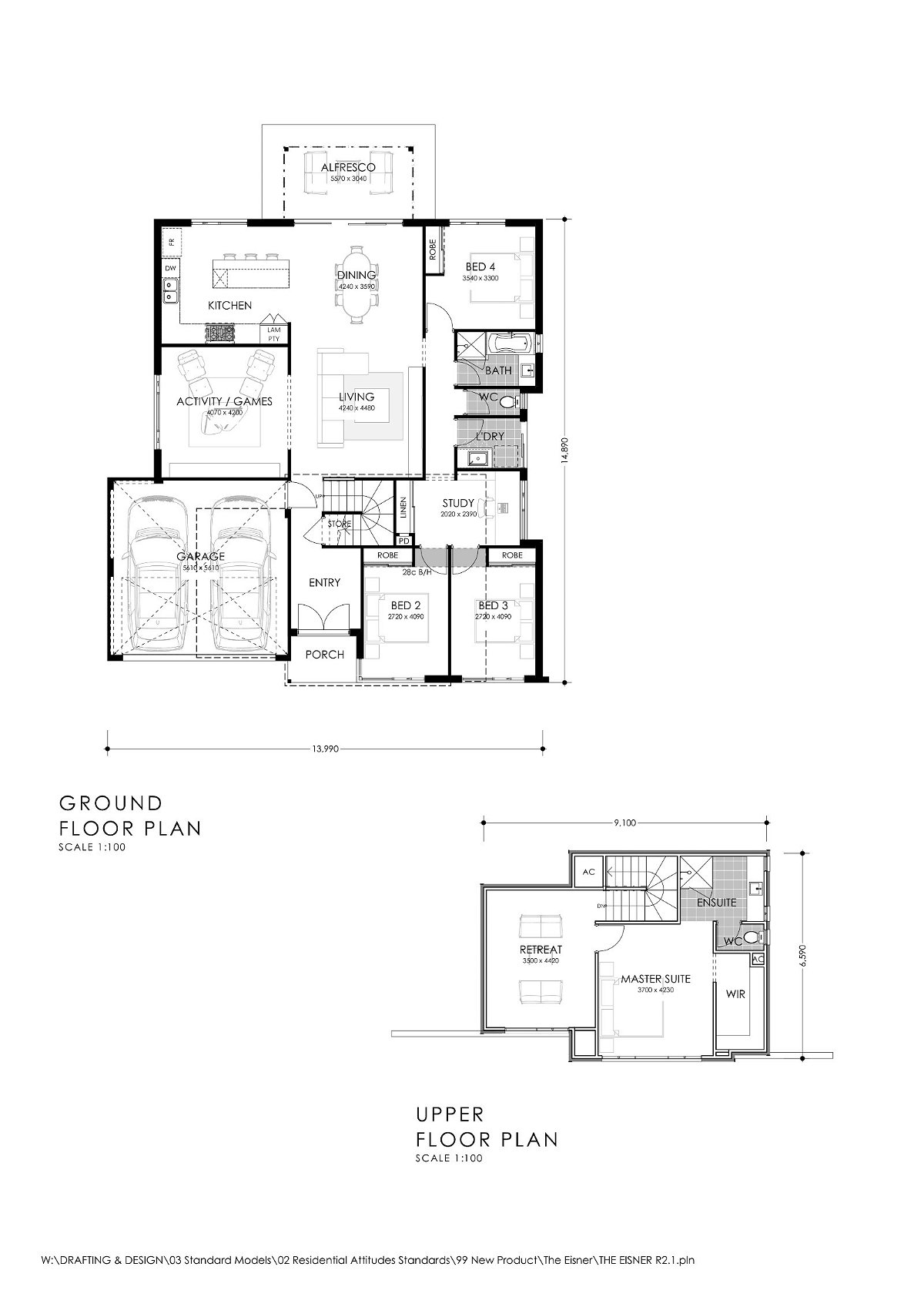

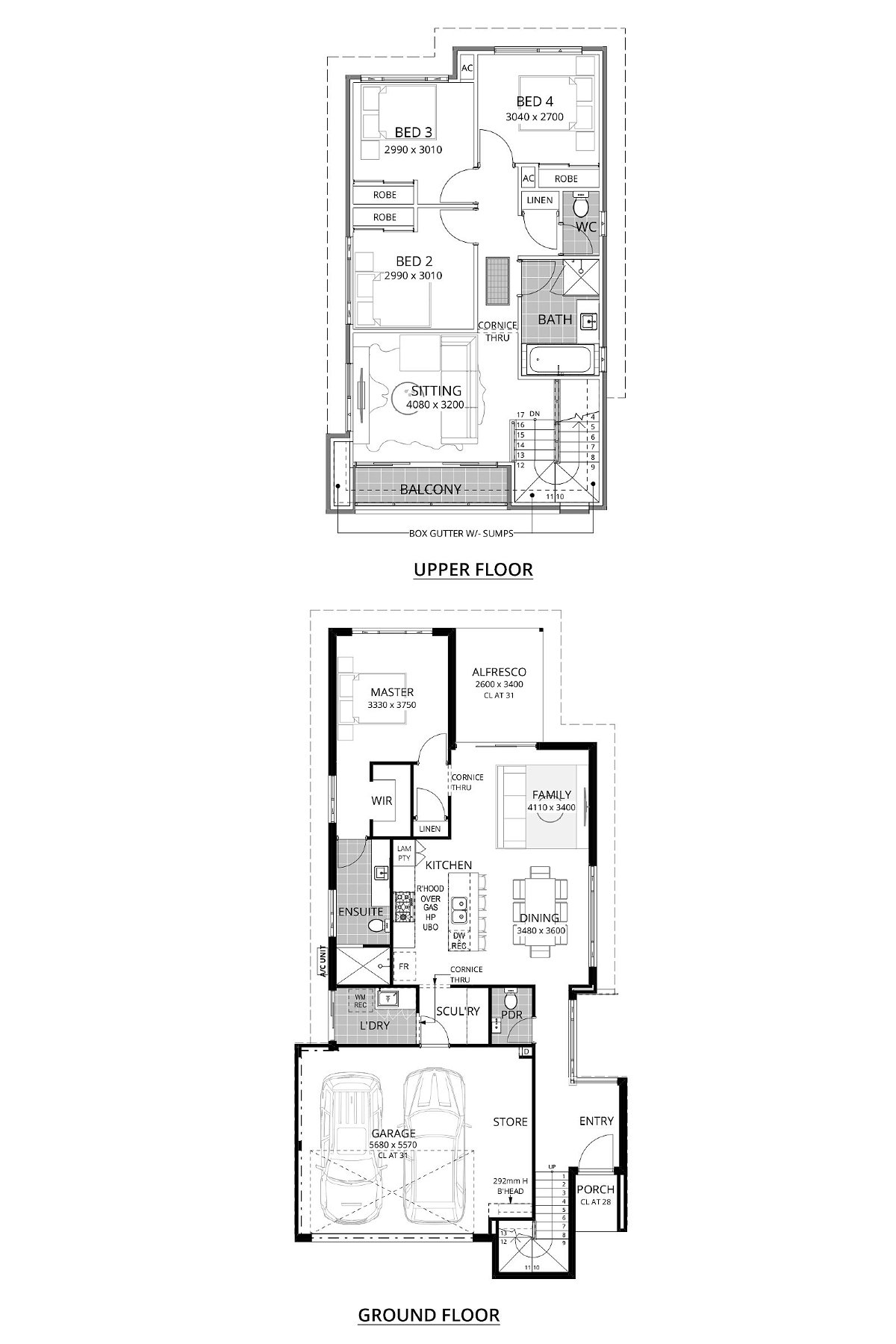

- Floorplan

Showing 1 - 30 of 122 designs